Following the recent Wireless Waffle post about Wes's excellent Soldery Song, it has been noted that the terms 'C-Band' and 'Ku-Band' were thrown around casually, as if everyone understands what these mean. For the benefit of those who don't, here's a short description of what they're all about:

It is perhaps no surprise that in the battle to gain access to Ka-Band, some of those doing the fighting are going to lose out. This seems to have happened to Australian satellite company NewSat. Recently both Morgan Stanley and Lazard have pulled out of the programme raising funds for the launch of NewSat's Jabiru 1 satellite. Digging into the economics of NewSat, it appears that the numbers just don't add up. The cost of their capacity would be around 50% higher than that of existing Ka-Band satellite operators, which might be a difficult sell when trying to raise lots of capital to build and launch a new satellite.

It is perhaps no surprise that in the battle to gain access to Ka-Band, some of those doing the fighting are going to lose out. This seems to have happened to Australian satellite company NewSat. Recently both Morgan Stanley and Lazard have pulled out of the programme raising funds for the launch of NewSat's Jabiru 1 satellite. Digging into the economics of NewSat, it appears that the numbers just don't add up. The cost of their capacity would be around 50% higher than that of existing Ka-Band satellite operators, which might be a difficult sell when trying to raise lots of capital to build and launch a new satellite.

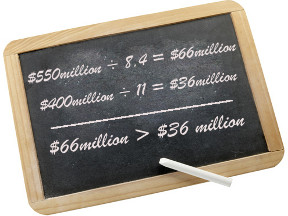

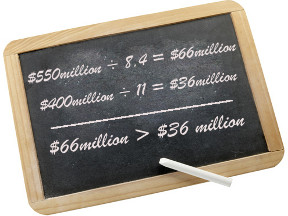

From the figures on their web-site, NewSat were going to pay Lockheed Martin US$550 million to build and launch their 'bird'. The resulting satellite would operate in a total of around 8.4 GHz of Ka-Band spectrum. Compare that to UK satellite company Avanti who paid US$400 million for their bird, but which accesses 11 GHz worth of Ka-Band spectrum. Do the maths and you see that NewSat would be paying approximately US$66 million to access each GHz of spectrum, whereas Avanti paid only US$36 million. This difference in cost is borne out in prices too, with NewSat claiming to be aiming to charge customers US$1.3 million for a transponder for 12 months. The equivalent price for Avanti is around US$0.9 million.

From the figures on their web-site, NewSat were going to pay Lockheed Martin US$550 million to build and launch their 'bird'. The resulting satellite would operate in a total of around 8.4 GHz of Ka-Band spectrum. Compare that to UK satellite company Avanti who paid US$400 million for their bird, but which accesses 11 GHz worth of Ka-Band spectrum. Do the maths and you see that NewSat would be paying approximately US$66 million to access each GHz of spectrum, whereas Avanti paid only US$36 million. This difference in cost is borne out in prices too, with NewSat claiming to be aiming to charge customers US$1.3 million for a transponder for 12 months. The equivalent price for Avanti is around US$0.9 million.

This may not yet be a Ka-tastrophe (groan) or even a Ka-lamity (double groan) for NewSat. NewSat suspended trading in its shares in November to give it time to re-think it's financing strategy. Maybe there is still a 'hope in heaven' for those communities that NewSat was intending to serve, if, of course, the other satellite operators don't get there first!

- C-Band (in satellite terms) refers to frequencies in the range of roughly 4 to 8 GHz. C-Band satellites are commonplace in areas where there is very heavy rainfall (eg tropical areas) as, using relatively low microwave frequencies, signals propagate better and suffer fewer rain fades. It's not the total amount of rain that matters, it's the voracity of the downpours.

- Ku-Band refers to frequencies roughly in the range of 10 to 15 GHz (the 'roughly' refering to the fact that uplinks and downlinks work in different bands that may or may not be within this range but are at least somewhere nearby). Ku-Band is the band most commonly used for digital satellite television broadcasting anywhere that it doesn't rain too heavily (eg most non-tropical areas). In many areas, the geostationary arc is near saturation in Ku-Band, with satellites positioned every 2 degrees or so. Some satellite operators have tried to launch broadband internet services in this band but the high levels of congestion make it difficult to find the space to do so.

- Ka-Band refers to frequencies roughly in the range of 20 to 30 GHz. Ka-Band is the relative newcomer on the block (though Italsat F1 conducted some tests in this band in the early 1990s). With Ku-Band becoming congested with broadcasting, satellite operators wishing to offer broadband services are increasingly turning to Ka-Band to do so and it is fast becoming the most hotly contested band for new satellite services. Already popular in the US, it is now being successfully commercialised in Europe and Africa. In emerging countries, where terrestrial (including wireless) broadband services are unlikely to be rolled-out any time soon, the use of Ka-Band satellite broadband is likely to open up Internet access to millions of people who wouldn't otherwise have a hope of getting a decent connection.

It is perhaps no surprise that in the battle to gain access to Ka-Band, some of those doing the fighting are going to lose out. This seems to have happened to Australian satellite company NewSat. Recently both Morgan Stanley and Lazard have pulled out of the programme raising funds for the launch of NewSat's Jabiru 1 satellite. Digging into the economics of NewSat, it appears that the numbers just don't add up. The cost of their capacity would be around 50% higher than that of existing Ka-Band satellite operators, which might be a difficult sell when trying to raise lots of capital to build and launch a new satellite.

It is perhaps no surprise that in the battle to gain access to Ka-Band, some of those doing the fighting are going to lose out. This seems to have happened to Australian satellite company NewSat. Recently both Morgan Stanley and Lazard have pulled out of the programme raising funds for the launch of NewSat's Jabiru 1 satellite. Digging into the economics of NewSat, it appears that the numbers just don't add up. The cost of their capacity would be around 50% higher than that of existing Ka-Band satellite operators, which might be a difficult sell when trying to raise lots of capital to build and launch a new satellite. From the figures on their web-site, NewSat were going to pay Lockheed Martin US$550 million to build and launch their 'bird'. The resulting satellite would operate in a total of around 8.4 GHz of Ka-Band spectrum. Compare that to UK satellite company Avanti who paid US$400 million for their bird, but which accesses 11 GHz worth of Ka-Band spectrum. Do the maths and you see that NewSat would be paying approximately US$66 million to access each GHz of spectrum, whereas Avanti paid only US$36 million. This difference in cost is borne out in prices too, with NewSat claiming to be aiming to charge customers US$1.3 million for a transponder for 12 months. The equivalent price for Avanti is around US$0.9 million.

From the figures on their web-site, NewSat were going to pay Lockheed Martin US$550 million to build and launch their 'bird'. The resulting satellite would operate in a total of around 8.4 GHz of Ka-Band spectrum. Compare that to UK satellite company Avanti who paid US$400 million for their bird, but which accesses 11 GHz worth of Ka-Band spectrum. Do the maths and you see that NewSat would be paying approximately US$66 million to access each GHz of spectrum, whereas Avanti paid only US$36 million. This difference in cost is borne out in prices too, with NewSat claiming to be aiming to charge customers US$1.3 million for a transponder for 12 months. The equivalent price for Avanti is around US$0.9 million.This may not yet be a Ka-tastrophe (groan) or even a Ka-lamity (double groan) for NewSat. NewSat suspended trading in its shares in November to give it time to re-think it's financing strategy. Maybe there is still a 'hope in heaven' for those communities that NewSat was intending to serve, if, of course, the other satellite operators don't get there first!

7 comments

( 2987 views )

| permalink

|

( 2.9 / 2001 )

( 2.9 / 2001 )

( 2.9 / 2001 )

( 2.9 / 2001 )